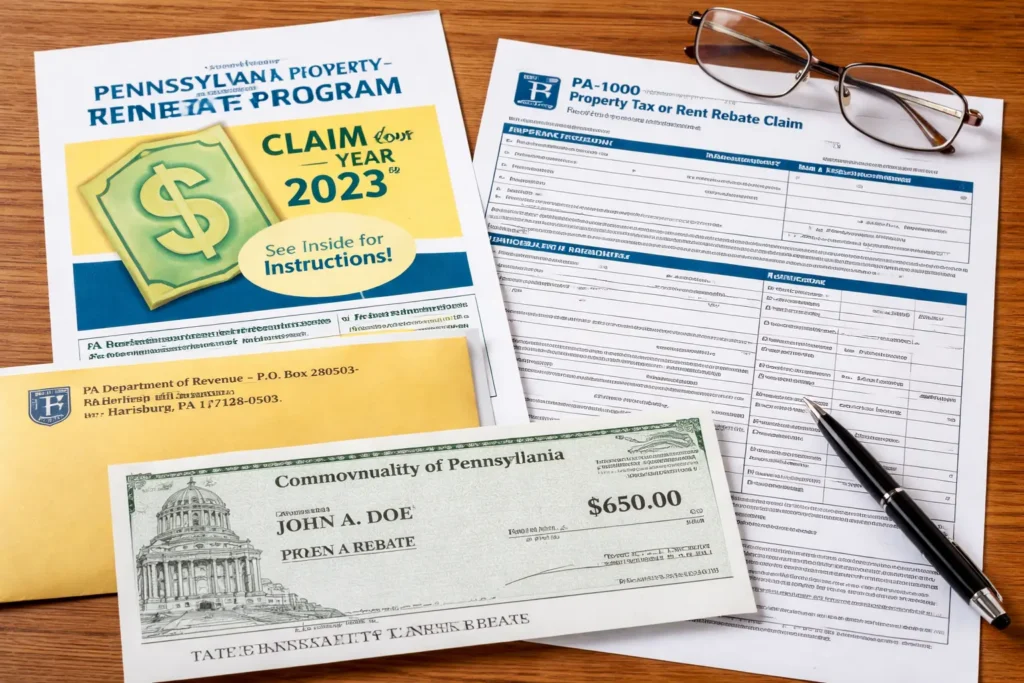

The Pennsylvania $1000 Tax Rebate 2026 offers eligible residents a one-time payment to help with costs. This guide explains who qualifies, the expected payment schedule, and clear steps to claim the money quickly.

Pennsylvania $1000 Tax Rebate 2026: What it is

The Pennsylvania $1000 Tax Rebate 2026 is a state-level program providing a single $1,000 payment to qualifying Pennsylvania residents. The rebate is separate from federal stimulus or tax credits and is meant to reduce household financial pressure in 2026.

Who is eligible for the Pennsylvania $1000 Tax Rebate 2026?

Eligibility rules vary by program details and may include income caps, residency requirements, or tax-filing status. Confirm the final requirements with the Pennsylvania Department of Revenue or the governor’s office.

- Must be a Pennsylvania resident at the eligibility date.

- Must meet income limits if the program applies means testing.

- May require filing a 2025 or 2024 Pennsylvania tax return, depending on the state rules.

- Some groups (pensioners, SSI recipients, or those on certain benefits) may qualify automatically or via simplified claims.

Common eligibility examples

- Low- and middle-income wage earner who filed a recent PA tax return and claimed standard credits.

- Senior on fixed income who receives state benefits and is listed in state records.

- Family with dependent children whose income falls under the program’s threshold.

Payment dates for the Pennsylvania $1000 Tax Rebate 2026

Exact payment dates are set by the state. Expect the timeline to include a first wave of direct deposit payments followed by mailed checks for people without bank info on file.

- Direct deposit payments: often delivered first, typically within several weeks of eligibility confirmation.

- Mailed checks: sent after direct deposits, often taking additional weeks for processing and postal delivery.

- Staggered schedule: payments may be issued in phases by tax-year filing or by ZIP code to manage processing.

Check the official Pennsylvania Department of Revenue site or governor’s press releases for the confirmed schedule and any updates after the program announcement.

How to claim your Pennsylvania $1000 Tax Rebate 2026 fast

Follow these practical steps to speed up your rebate delivery. Many delays happen because records are outdated or missing bank details.

- Verify eligibility: Read the official eligibility rules linked from the PA Department of Revenue site.

- File or update your PA tax return: If the rebate uses recent tax returns, file timely and accurately.

- Register or update your state tax account: Use the official online portal to confirm personal details and direct deposit information.

- Provide direct deposit info: If allowed, add your bank account and routing number to get fast electronic payment.

- Submit any required claim form: Some residents must complete a short online form to trigger payment.

- Track your payment: Use the state’s payment status tool or hotline to check where your rebate is in processing.

Documents and information to have ready

- Social Security Number or Individual Taxpayer ID

- Recent Pennsylvania tax return or proof of residency

- Bank routing and account numbers for direct deposit

- Driver’s license or state ID for identity confirmation

Some Pennsylvania rebates are applied automatically using state tax records, while others require a short online claim. Updating your state tax account speeds up electronic payments.

What to do if you don’t receive the $1000 rebate

Not receiving a rebate can be frustrating. Use a methodical approach to find and resolve the issue quickly.

- Check the state payment status portal first.

- Confirm your direct deposit information and recent tax filings.

- Contact the Pennsylvania Department of Revenue or the program hotline with your details ready.

- If payment was mailed and lost, ask about stop-payment and reissue policies.

- Look for notices in mail or email from the state with follow-up instructions.

When to contact the state

If the payment window in official guidance has passed and you see no record of payment, contact the state. Keep your tax return, ID, and bank info handy to speed the call.

Case study: How one household claimed the rebate fast

Maria, a nurse from Pittsburgh, checked the PA Department of Revenue site right after the rebate was announced. She confirmed she qualified, updated her direct deposit in the state tax portal, and filed a short online claim form.

Result: Maria received an email confirmation within 10 days and the direct deposit arrived in 21 days. Updating bank details and filing the required form saved her weeks compared with waiting for a mailed check.

Key takeaways for the Pennsylvania $1000 Tax Rebate 2026

To claim your rebate quickly, confirm eligibility, keep tax records current, and provide direct deposit information if the program allows. Always use official state websites and verified phone numbers for updates.

For final payment dates and program rules, bookmark the Pennsylvania Department of Revenue announcements and check them regularly as the 2026 payment window approaches.